Introduction: Why You Need a Strategy for 2026

As we look toward the horizon of 2026, the real estate landscape in Florida continues to evolve. For prospective homebuyers and current homeowners in Dunedin and the greater Tampa Bay area, the days of simply “winging it” are over. Successful homeownership in today’s economic climate requires foresight, preparation, and a strategic partnership with a knowledgeable local expert.

Whether you are a first-time homebuyer dreaming of a bungalow near the Pinellas Trail, or an investor looking to expand your portfolio in Pinellas County, planning your mortgage strategy a year in advance can be the difference between a stressful transaction and a seamless victory. At Mortgage Info By Sean, we believe that education is the most powerful tool in your financial arsenal.

This guide serves as your 2026 roadmap. We will break down the steps you need to take now to ensure you are ready to act when the right property hits the market. From understanding credit nuances to navigating Florida’s unique insurance requirements, Sean McManamon and his team are here to guide you every step of the way.

The Dunedin, FL Real Estate Market: What to Expect in 2026

Dunedin is no longer a hidden gem; it is a sought-after destination known for its walkable downtown, pristine beaches like Honeymoon Island, and vibrant community spirit. Because of this, the local market behaves differently than national averages.

Local Inventory and Demand

As we approach 2026, we anticipate that Dunedin will remain a competitive market. High demand often leads to multiple-offer scenarios. This makes having a rock-solid pre-approval—not just a pre-qualification—essential. Sellers in our area prioritize buyers who have their financing fully vetted by a reputable local lender over those with generic letters from big-box online banks.

The Florida Insurance Factor

One specific challenge for Florida buyers is the cost of homeowners insurance. When calculating your budget for 2026, you cannot rely on national mortgage calculators that estimate insurance at $100 a month. As a local mortgage broker, Sean McManamon helps you factor in realistic insurance premiums and property taxes early in the process, ensuring your Debt-to-Income (DTI) ratio remains healthy and your monthly payments are comfortable.

Your 2026 Mortgage Roadmap: A Step-by-Step Plan

Achieving your homeownership goals requires a structured timeline. Here is the strategy we recommend for clients planning to buy in 2026.

Phase 1: The Financial Health Check (6-12 Months Out)

Before you ever look at a listing, you must look at your finances.

- Review Your Credit Report: Pull your credit report from all three bureaus. Look for errors, outstanding collections, or high utilization rates. Contact us to discuss how credit repair strategies might improve your interest rate tier.

- Analyze Your DTI: Lenders look at your Debt-to-Income ratio to determine how much home you can afford. If you have significant credit card debt or car loans, focus on paying these down now to increase your purchasing power later.

- Save for the “Full” Cost: Beyond the down payment, you need to budget for closing costs (typically 2% to 5% of the purchase price), inspections, and moving expenses.

Phase 2: The Strategy Call (3-6 Months Out)

This is where the magic happens. Schedule a Strategy Call with Sean McManamon. Unlike an automated system, a strategy call allows us to:

- Discuss your long-term financial goals.

- Compare different loan programs (Conventional, FHA, VA, USDA).

- Run scenarios using our mortgage calculators to see how different interest rates and down payments affect your bottom line.

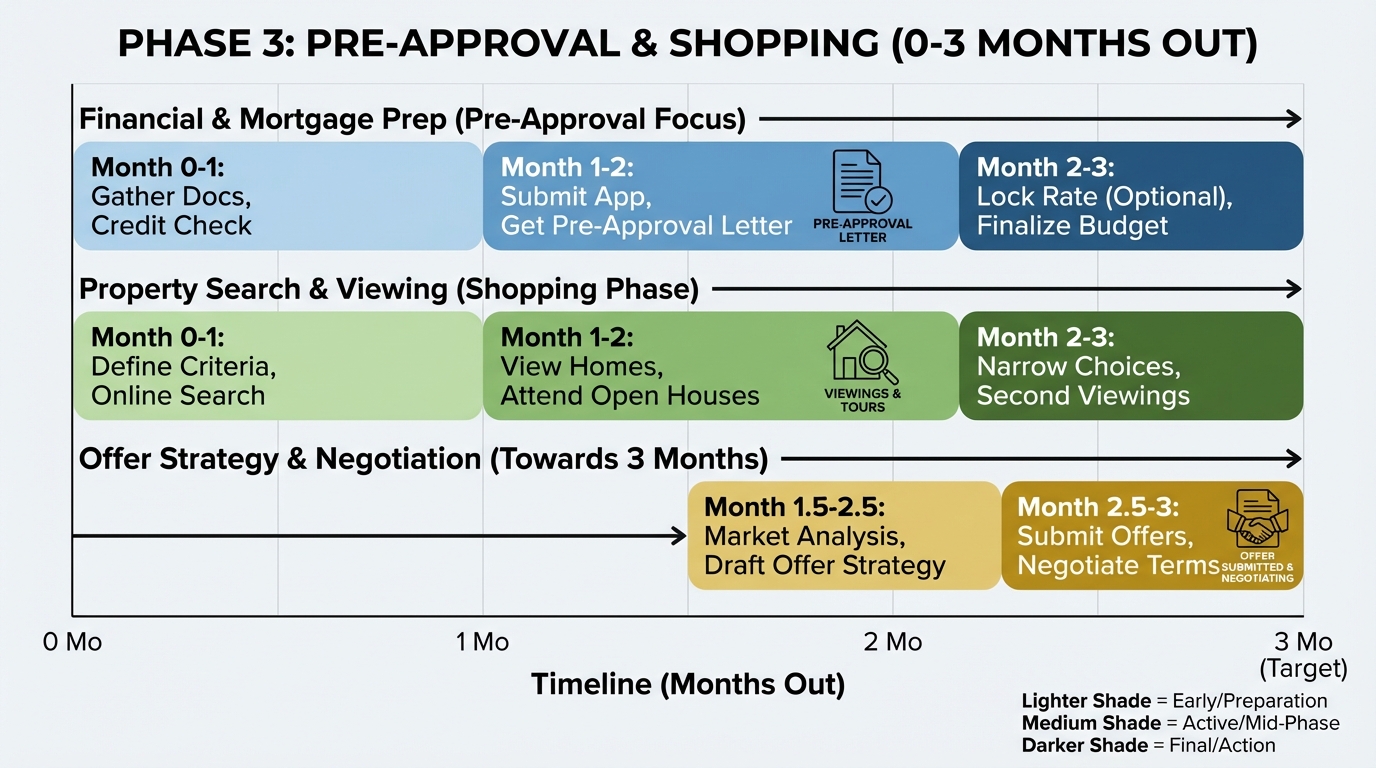

Phase 3: Pre-Approval and Shopping (0-3 Months Out)

Once your finances are optimized, we move to the formal application. Our secure online application takes just 12 minutes to complete. Once submitted, we gather your documents (W2s, bank statements, tax returns) for underwriting review. With a verified pre-approval letter in hand, you are ready to tour homes with your real estate agent, confident that you can close the deal.

Choosing the Right Loan Product for 2026

One size does not fit all. The mortgage landscape offers various tools depending on your down payment capability and credit history. Below is a comparison of loan types we frequently structure for our Dunedin clients.

| Loan Program | Ideal Borrower Profile | Down Payment Requirement | Key Benefit for 2026 |

|---|---|---|---|

| Conventional Fixed-Rate | Strong credit (620+), stable income. | As low as 3% for first-time buyers; typically 5-20%. | Stability. Your principal and interest payment never changes, regardless of market volatility. |

| FHA Loan | Borrowers with lower credit scores or higher debt ratios. | 3.5% | Accessibility. More lenient underwriting guidelines allow you to enter the market sooner. |

| VA Loan | Veterans, active duty military, and surviving spouses. | 0% | No mortgage insurance (PMI) and competitive interest rates. The best loan available for those who serve. |

| Adjustable-Rate Mortgage (ARM) | Buyers planning to move or refinance within 5-7 years. | Varies (typically 5-10%) | Lower initial interest rate compared to fixed loans, increasing buying power in the short term. |

| Jumbo Loan | Buyers purchasing luxury properties exceeding conforming limits. | Typically 10-20% | Allows for the purchase of high-value homes in premium Dunedin neighborhoods. |

Note: Loan terms and requirements are subject to change. Contact Sean McManamon for the most current guidelines.

Why Work with a Local Mortgage Broker vs. a Big Bank?

In a fluctuating economy, who you borrow from matters as much as how much you borrow. Here is why Dunedin residents trust Mortgage Info By Sean:

- We Are Your Neighbors: We understand the local market, from condo associations in Clearwater to single-family homes in Palm Harbor and Dunedin. We know which properties have unique financing requirements.

- Speed and Agility: Big banks often have bureaucratic layers that slow down the process. We pride ourselves on a streamlined workflow: Strategy -> Pre-Approval -> Processing -> Underwriting -> Closing. We aim to hit your closing date on time, every time.

- Access to Multiple Lenders: As a broker, Sean isn’t tied to one bank’s products. He shops the wholesale market to find you the best rate and terms available, potentially saving you thousands over the life of your loan.

- Personalized Service: You are not a loan number to us. We provide individual attention, answering your calls and explaining the “why” behind every number.

5 Frequently Asked Questions (FAQs) for 2026 Homebuyers

1. What are the predicted mortgage interest rates for 2026?

2. How much cash do I really need to close on a home in Dunedin?

You will need your down payment (3.5% to 20% typically) plus closing costs. Closing costs in Florida generally range from 2% to 5% of the purchase price. This covers appraisal fees, title insurance, lender fees, and pre-paid items like property taxes and homeowners insurance. We provide a detailed “Loan Estimate” so you know exactly what to expect.

3. Can I buy a home if I have student loan debt?

Yes! Student loans are factored into your Debt-to-Income (DTI) ratio, but they do not automatically disqualify you. FHA and Conventional loans have different ways of calculating student loan payments (even if they are in deferment). During your strategy call, we can calculate your DTI to see how much home you qualify for.

4. What is the difference between Pre-Qualification and Pre-Approval?

A pre-qualification is a rough estimate based on self-reported information. A pre-approval is a verified commitment from a lender based on a review of your documents (pay stubs, tax returns). In the competitive Dunedin market, a pre-approval letter is mandatory to have your offer taken seriously by sellers.

5. How does the “12-minute application” work?

Our technology-driven process is designed for your convenience. Through our secure website, you can submit your complete loan application online in about 12 minutes. This initiates the process, allowing us to review your file and issue a pre-approval quickly so you can start shopping without delay.

Conclusion: Start Your Journey Today

2026 holds incredible promise for those who prepare. Whether you are looking to buy your first home, upgrade to a larger space, or refinance an existing loan, the key to success is early planning and expert guidance.

Don’t navigate the complex world of mortgages alone. Let Sean McManamon and his team provide the clarity, strategy, and competitive loan options you deserve.

Ready to Build Your 2026 Mortgage Plan?

Take the first step toward your dream home in Dunedin, FL.

Contact Sean McManamon Today

📞 Phone: 1-727-639-5968

📧 Email: sean@mortgagesbysean.com

🌐 Apply Online: Start Your 12-Minute Application